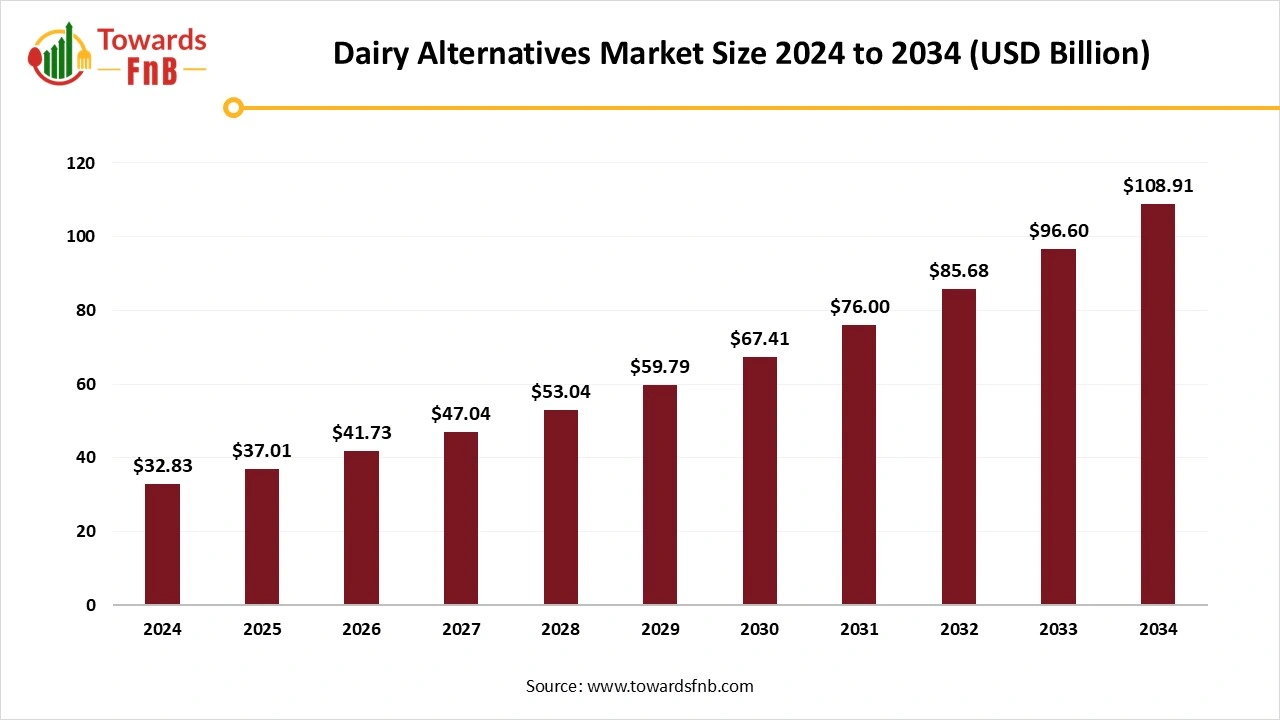

Dairy Alternatives Market Set to Surpass USD 108.91 Billion by 2034, Driven by Health Trends and Consumer Shifts

According to Towards FnB, the global dairy alternatives market size is calculated at USD 37.01 billion in 2025 with an expected growth trajectory to USD 108.91 billion by 2034, reflecting at an impressive CAGR of 12.74% from 2025 to 2034. This rapid growth highlights the increasing consumer shift towards plant-based, dairy-free products driven by changing dietary preferences and health concerns.

Ottawa, Nov. 27, 2025 (GLOBE NEWSWIRE) -- The global dairy alternatives market size stood at USD 32.83 billion in 2024 and is predicted to increase from USD 37.01 billion in 2025 to reach around USD 108.91 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is expected to grow due to lactose intolerance among consumers of all ages. The growing population of vegans, flexitarians, and vegetarians' demand for dairy alternatives is another major factor for the market’s growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5930

Key Highlights of the Dairy Alternatives Market

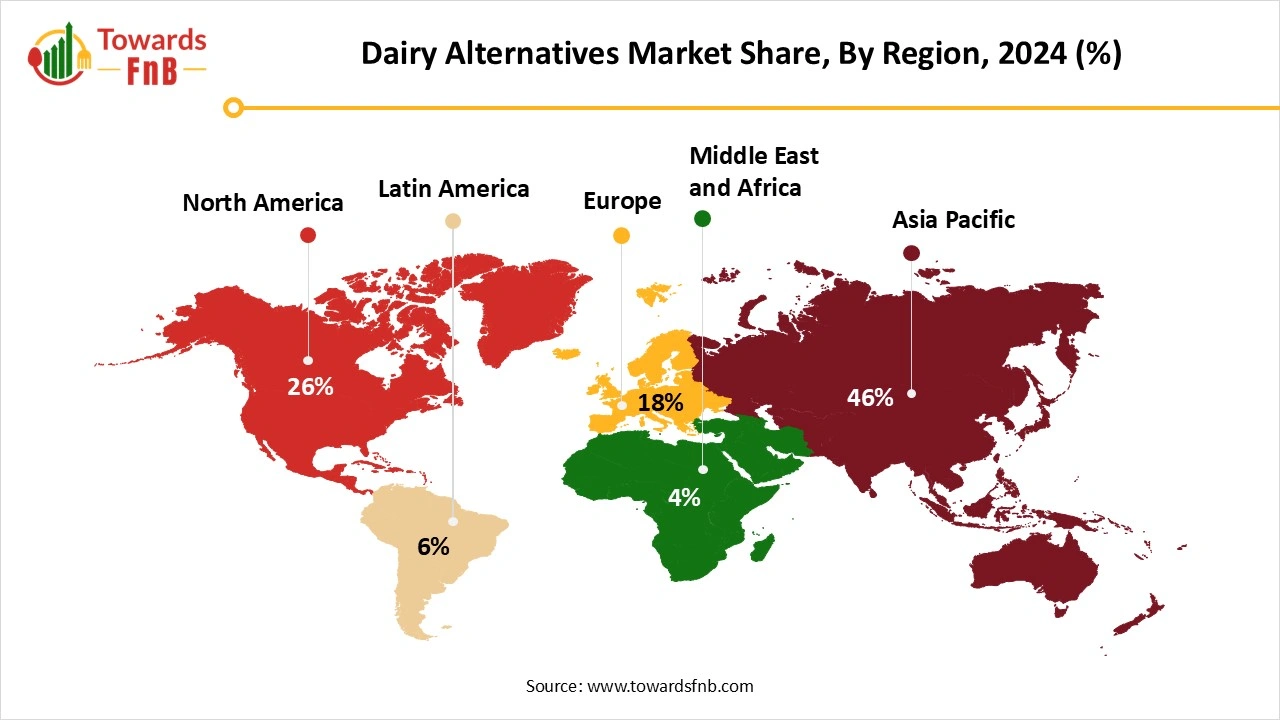

- By region, Asia Pacific led the dairy alternatives market with highest share of % in 2024, whereas North America is expected to grow in the foreseeable period.

- By source, the soy segment led the dairy alternatives market in 2024, whereas the almond segment is expected to grow in the foreseeable period.

- By product, the milk segment dominated the dairy alternatives market in 2024, whereas the ice-cream segment is expected to grow in the foreseeable period.

- By distribution channel, the supermarket and hypermarket segment led the dairy alternatives market in 2024, whereas the online retail segment is expected to grow in the foreseeable period.

A Health-Conscious Crowd is Helpful to Boost the Dairy Alternatives Industry

The dairy alternatives market is observed to grow due to high demand for health-conscious, ethical, and dairy-free options. Such options are low in cholesterol and fat, which is further helpful for the market’s growth. Consumer awareness of health, wellness, and nutrition also supports market growth, driving consumer demand for plant-based and vegan options. Dairy-free product manufacturers also help drive product innovation and introduce a range of products with different flavor options, further fueling market growth.

Technological Innovations Are Helpful for the Market’s Growth

Technological innovations such as precision fermentation, cell-based milk production, and improved plant-based formulations, the use of microorganisms, and novel ingredients help to enhance the quality of plant-based milk, further fueling the growth of the dairy alternatives market. The use of advanced processing methods, such as non-thermal pasteurization, to produce high-quality dairy proteins and similar products also helps fuel market growth. Such technological innovations also help ensure that the quality, nutritional value, taste, and texture of dairy-free alternatives remain similar to those of dairy products, propelling market growth.

Impact of AI in the Dairy Alternatives Market

Artificial intelligence (AI) is transforming the dairy alternatives market by improving product innovation, manufacturing efficiency, and consumer alignment. In research and formulation, AI-powered algorithms analyze data on plant proteins, fats, emulsifiers, and flavor compounds to develop dairy alternatives that closely replicate the taste, creaminess, and functionality of traditional milk, yogurt, cheese, and ice cream. Machine learning models simulate how ingredients such as oats, almonds, soy, coconuts, and peas behave under different processing conditions, reducing trial-and-error and accelerating the development of smoother textures, better foaming properties, and enhanced nutritional profiles.

AI-driven predictive analytics optimize soaking, grinding, fermentation, and homogenization processes to maintain consistency and reduce waste. Computer vision systems monitor raw materials for impurities, color variations, and microbial risks, ensuring the production of safe, high-quality dairy-free products. These systems improve batch uniformity and help manufacturers meet clean-label and allergen-free standards.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/dairy-alternatives-market

Recent Developments in the Dairy Alternatives Market

- In September 2025, Strauss Group announced the launch of its ‘animal-free’ line of dairy products in Israel. The initial products of the line will involve CowFree Symphony cream cheese and the Yotvata CowFree drink. The products have been produced in collaboration with Imagindairy, an Israel-based animal-free protein startup.

- In April 2025, DairyPure launched its range of flavored milk- ‘Milk50’ in original, chocolate, and vanilla flavor options. The flavored milk range combines various nutritional elements with just 50 calories and 6 grams of protein per serving. It is a lactose-free formulation with 75% less sugar and made with fat-free skimmed milk.

New Trends of the Dairy Alternatives Market

- Product innovation, driving market growth through high demand for oat milk, soy milk, and almond milk, is fueling the market primarily in recent periods.

- Dairy-free products enriched with various nutritional elements are another major factor for the market’s growth.

- Higher usage of technological advancements to maintain the taste and texture of dairy-free products is another major factor for the market’s growth.

Product Survey of the Dairy Alternatives Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or End Use Segments | Representative Producers or Brands |

| Plant-Based Milk Alternatives | Non-dairy beverages are used as substitutes for cow’s milk. | Almond milk, soy milk, oat milk, coconut milk, rice milk, cashew milk | Retail beverages, coffee, smoothies, and cooking | Silk, Alpro, Oatly, Califia Farms |

| Plant-Based Yogurt Alternatives | Fermented plant-based products formulated to mimic dairy yogurt. | Almond yogurt, coconut yogurt, soy yogurt, oat yogurt | Breakfast, snacking, functional foods | Kite Hill, Chobani Oat Yogurt, Silk Yogurt |

| Plant-Based Cheese Alternatives | Dairy-free formulations designed to replicate cheese texture and flavor. | Slices, shreds, blocks, cream cheese alternatives | Pizza, sandwiches, bakery, home cooking | Daiya, Violife, Miyoko’s Creamery |

| Plant-Based Ice Cream and Frozen Desserts | Non-dairy frozen options made from plant-based bases. | Coconut ice cream, almond ice cream, oat ice cream, soy ice cream | Dessert retail, premium frozen products | Ben and Jerry’s Non-Dairy, So Delicious, Halo Top Dairy Free |

| Plant-Based Butter Alternatives | Spreads and baking blocks made from plant oils. | Vegan butter, margarine alternatives, coconut butter | Cooking, baking, spreading | Flora Plant Butter, Miyoko’s Butter, Earth Balance |

| Plant-Based Cream and Creamers | Dairy-free substitutes for cooking cream and coffee creamers. | Coconut cream, almond creamer, oat creamer, soy creamer | Coffee, sauces, soups | Califia Farms Creamer, Silk Creamer |

| Plant-Based Protein Drinks | High protein dairy alternative beverages for fitness and wellness. | Soy protein drinks, pea protein drinks, hemp protein drinks | Sports nutrition, health beverages | Ripple Foods, OWYN |

| Plant-Based Infant Formula | Vegan or lactose-free infant formulas for sensitive digestive needs. | Soy-based formula, rice-based formula | Infant nutrition | Enfamil ProSobee, Similac Soy Isomil |

| Plant-Based Dessert and Pudding Alternatives | Non-dairy puddings and ready-to-eat desserts. | Almond pudding, coconut pudding | Retail-ready desserts | Alpro Desserts, So Delicious |

| Plant-Based Cooking Sauces and Creams | Creamy sauces formulated without dairy. | Vegan alfredo, vegan cheese sauces | Foodservice, retail sauces | Follow Your Heart, Daiya Sauces |

| Plant Based Cheese Spreads and Dips | Spreadable vegan cheese-like products. | Cashew cheese dip, almond cheese spreads | Snacking, home cooking | Boursin Dairy Free, Good Foods Plant-Based |

| Plant-Based Kefir and Fermented Drinks | Non-dairy probiotic beverages made from plant bases. | Coconut kefir, almond kefir, oat kefir | Gut health, functional beverages | GT’s CocoYo, Forager Project |

| Plant-Based Cream Cheese Alternatives | Dairy-free spreads formulated for bagels, baking, or frostings. | Almond cream cheese, soy cream cheese, cashew cream cheese | Retail spreads, bakery | Kite Hill Cream Cheese, Tofutti |

| Plant-Based Whipping Cream and Foams | Dairy-free whipping alternatives for dessert applications. | Coconut whipping cream, soy whipping cream | Bakery, beverages | Rich’s Whip Topping Non-Dairy, Silk Whipping Cream |

| Plant-Based Ready Meals with Dairy-Free Components | Meals formulated entirely without dairy ingredients. | Vegan lasagna, dairy-free mac and cheese | Frozen meals, retail convenience | Amy’s Kitchen, Wicked Kitchen |

| Unsweetened and Sugar-Free Dairy Alternatives | Low sugar or sugar-free versions of plant-based milks and yogurts. | Unsweetened almond milk, sugar-free soy milk | Keto diets, diabetic friendly options | Silk Unsweetened, Califia Farms Unsweetened |

| Fortified Dairy Alternatives | Plant-based dairy products with added vitamins and minerals. | Calcium fortified, vitamin D fortified, B12 fortified | Nutritional wellness, dairy replacement | Private label fortified lines, mainstream brands |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5930

Dairy Alternatives Market Dynamics

What Are the Growth Drivers of the Dairy Alternatives Market?

The growing population of health-conscious consumers, vegans, vegetarians, and flexitarians is a major factor driving market growth. Dairy-free alternatives are low in cholesterol and fat and are therefore highly sought by consumers seeking to maintain their nutritional charts. The rising number of intolerant individuals is another major factor driving market growth. Such food and beverages options are also cost-effective and ideal for people who cannot consume lactose, hence are helpful for the market’s growth. Hence, they are widely used by the food and beverage industry to manufacture dairy-free alternatives, which supports the market’s growth.

Challenge

Consumer Perception May Obstruct the Market’s Growth

Many dairy-free alternative companies are unable to match the taste and texture of dairy-free products to those of dairy products. Hence, many consumers are dissatisfied with such products, further hindering market growth. They are also unable to match the protein and other nutritional levels of the dairy-based product, further impacting the market’s growth. Hence, such issues combined may create an obstruction in the growth of the dairy alternatives market.

Opportunity

Higher Demand for Functional Products Is Helpful for the Market’s Growth

Many dairy-free alternative companies are launching products enriched with essential nutrients, such as vitamins, minerals, and high protein. It helps consumers to maintain their nutritional profile in dairy-free form. Such companies are also launching a range of dairy-free products with diverse flavor profiles, further fueling market growth in the foreseeable period and expanding the consumer base. It helps attract consumers by defining the health benefits of such products.

Trade Analysis of the Dairy Alternatives Market

Import & Export Statistics

Global Trade Scale and Recent Trend Signals

- The dairy alternatives market continues to expand rapidly, with global market estimates clustering in the low-to-mid tens of billions of US dollars for 2024 and strong multi-year growth forecasts as consumers shift toward plant-based diets and fortified alternatives. Market research groups report that global dairy alternatives (plant-based milks and related products) were valued at around US$34 billion in 2024, with projections of significant growth through the 2020s driven by product innovation, new geographic demand, and wider retail distribution.

Leading Exporters (Value and Volume)

- Trade in finished dairy alternative products is closely linked to where production scales are located and where raw materials are processed. Major corporate producers and manufacturing hubs in Europe and North America supply much of the finished product exports (brands such as Danone/Alpro, Oatly, Califia Farms and Blue Diamond lead cross-border shipments and private label supply). At the raw material level, the world’s leading soybean producers and exporters (Brazil and the United States) underpin soy-based alternatives, while Spain and the United States are major origin suppliers for almonds used in almond milk manufacturing. These upstream supplier nations, therefore, play an outsized role in securing feedstock for exporters of finished dairy alternative goods.

Major Importers and Demand Hubs

- Import demand is concentrated in high-consumption, rapidly adopting markets: North America and Western Europe remain large retail markets for finished plant-based milks and yogurts, while East Asia and the Gulf states show fast growth in fortified and specialty formats. Retailers and foodservice buyers in the EU, the United States and China import both finished retail SKUs and intermediate ingredients (e.g., concentrate, protein isolates). Growing middle classes and health-driven consumption in Southeast Asia and the Middle East create important secondary demand hubs for imports and regional manufacturing.

Product Forms, Pricing, and Logistics That Shape Trade

- Trade covers ambient shelf-stable cartons (UHT), refrigerated ready-to-drink formats, aseptic pouches, concentrated bases and isolates (oat concentrates, almond paste, soy protein), and specialty ingredients for infant and clinical nutrition. Logistics differ by form: shelf-stable UHT and concentrates travel in standard containerised freight, while fresh refrigerated SKUs require cold chain and faster transit. Price sensitivity is driven by raw material cycles (soybean harvests, almond yields, oat availability), processing yields and fortification costs. Manufacturers sometimes adopt “asset-light” and regional production strategies to reduce cross-border freight costs and adapt quickly to local tastes and price points.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Dairy Alternatives Market Regional Analysis

Asia Pacific Led the Dairy Alternatives Market in 2024

Asia Pacific dominated the dairy alternatives market in 2024 due to changing consumer lifestyles, rising disposable income, evolving consumer preferences, and other factors supportive of market growth. The growing number of lactose-intolerant individuals in the region is another major factor driving the market’s growth. The growing population of vegans and flexitarians in search of dairy-free options also helps propel market growth in the foreseeable future. India has made a major contribution to the growth of the regional market, driven by the growing population of vegans and flexitarians seeking healthier, dairy-free options.

North America Is Observed to Be the Fastest-Growing Region in the Foreseeable Period

North America is expected to be the fastest-growing region over the forecast period, driven by high demand for dairy alternatives among lactose-intolerant consumers and changing consumer lifestyles. Higher demand for plant-based, protein-rich, and functional food and beverage options from health-conscious consumers in the region is another major factor driving the market's growth in the foreseeable future. The US plays a major role in the growth of the region's dairy alternatives market, driven by the rising number of lactose intolerants, which is leading to higher demand for vegan and plant-based options.

Europe Is Observed to Have a Notable Growth in the Foreseeable Period

Europe is expected to see notable growth over the forecast period, driven by the growing population of health-conscious consumers. Hence, consumers in the region demand vegan, organic, and plant-based options that help maintain the nutritional profile. The rising number of vegans and flexitarians in the region also drives demand for dairy alternatives, such as soy-based milk, ice cream, yoghurt, and protein snacks, further fueling market growth.

Dairy Alternatives Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 12.74% |

| Market Size in 2025 | USD 37.01 Billion |

| Market Size in 2026 | USD 41.73 Billion |

| Market Size by 2034 | USD 108.91 Billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Dairy Alternatives Market Segmental Analysis

Source Analysis

The soy segment led the dairy alternatives market in 2024 due to its multiple nutritional benefits. Soy is a high-protein, calcium-rich, and vitamin-rich ingredient used in the manufacturing of various dishes. It is an ideal dairy replacement and is used to manufacture plant-based ice creams, yoghurts, and cheese. Hence, consumers who are lactose intolerant can opt for such food and beverage options, thereby driving market growth. Soy is a highly nutritious, cost-effective plant-based ingredient, driving market growth. Hence, the food and beverage industries use it to manufacture dairy alternative products a large scale, further fueling the market's growth.

The almond segment is expected to be the fastest-growing over the forecast period, driven by its abundant health benefits. Almonds are full of vitamin E and antioxidants, making them a superfood. It is widely used for the manufacturing of various food products, such as almond milk, drinks, cereals, and more. Hence, it is an ideal ingredient for food manufacturers producing dairy alternatives and for health-conscious consumers following a vegan or flexitarian diet.

Product Analysis

The milk segment dominated the dairy alternatives market in 2024, as it is a beverage option used daily by consumers. Dairy-free milk is cost-effective and widely used for coffee, tea, baking, cereal bowls, and other recipes. Companies are also offering dairy-free alternatives in organic, functional, and flavored options, further fueling market growth. They are highly preferred by the health-conscious crowd and by consumers following a plant-based or a flexitarian diet.

The ice-cream segment is expected to grow over the forecast period due to high consumer demand for dairy-free ice-cream options across different age groups. Companies today are offering dairy-free ice cream in a variety of flavors, further fueling market growth in the foreseeable future. These are available with the same taste and texture as dairy-based ice cream but in a plant-based form.

Distribution Channel Analysis

The supermarkets and hypermarkets segment led the dairy alternatives market in 2024 due to the easy availability of these stores near residential areas, enabling consumers to shop for a variety of products. Such stores have different sections for different product categories, allowing consumers to choose the right product. Such products are available at cost-effective prices and across different categories, which is helpful for the market’s growth. In-store promotions to attract consumers also help market growth.

The online retail segment is expected to grow in the foreseeable future due to the platform's convenience, which is helping drive market growth. Online platforms offer a wide product portfolio, allowing consumers to select the right product for their preferences and shop smartly. The platform also offers multiple discounts to its consumers, further fueling market growth in the foreseeable future. Online platforms provide detailed information and reviews of new products, helping consumers find the right product.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Dairy Alternatives Market

- Earth’s Own – A Canadian plant-based beverage producer offering oat, almond, and soy milks made from sustainably sourced ingredients. The company focuses on clean-label formulations and environmentally responsible farming practices.

- SunOpta – A major supplier of plant-based beverages and ingredients, producing oat, soy, almond, and coconut bases for retail and foodservice. The company operates vertically integrated manufacturing with a strong sustainability focus.

- Melt Organic – A U.S.-based company known for its plant-based butter alternatives made from organic coconut, flaxseed, and other plant oils. It targets vegan and dairy-free consumers seeking clean-label spreads.

- Oatly AB – A global leader in oat-based milk, yogurts, ice creams, and creamers using patented enzyme-based processing. Oatly emphasizes sustainability, carbon transparency, and widespread foodservice partnerships.

- Blue Diamond Growers – A leading California almond cooperative producing Almond Breeze beverages and almond-based ingredients. Its large-scale processing capacity supports global demand for almond milk and dairy-free products.

- Ripple Foods – A U.S. company known for its pea protein-based milk, protein shakes, and creamers. Ripple focuses on high-protein, allergen-friendly formulations with lower environmental impact.

- Vitasoy International Holdings Ltd – A pioneer in soy-based beverages, now expanded into oat, coconut, and almond drinks across Asia-Pacific. The company emphasizes nutrition, sustainability, and broad retail penetration.

- Organic Valley – A farmer-owned cooperative offering organic, lactose-free, and dairy alternative beverages, including plant-based protein and organic soy milks. It focuses on regenerative agriculture and clean-label production.

-

Living Harvest – Specializes in hemp-based dairy alternatives, including Hemp Bliss beverages and plant-based proteins. The company targets allergen-free, non-GMO, and nutrient-dense formulations for health-conscious consumers.

Segments Covered in the Market

By Source

- Soy

- Almond

- Coconut

- Rice

- Oats

- Others

By Product

- Milk

- Yogurt

- Cheese

- Ice Cream

- Creamer

- Others

By Distribution Channel

- Supermarket & Hypermarkets

- Convenience Stores

- Online retail

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5930

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.